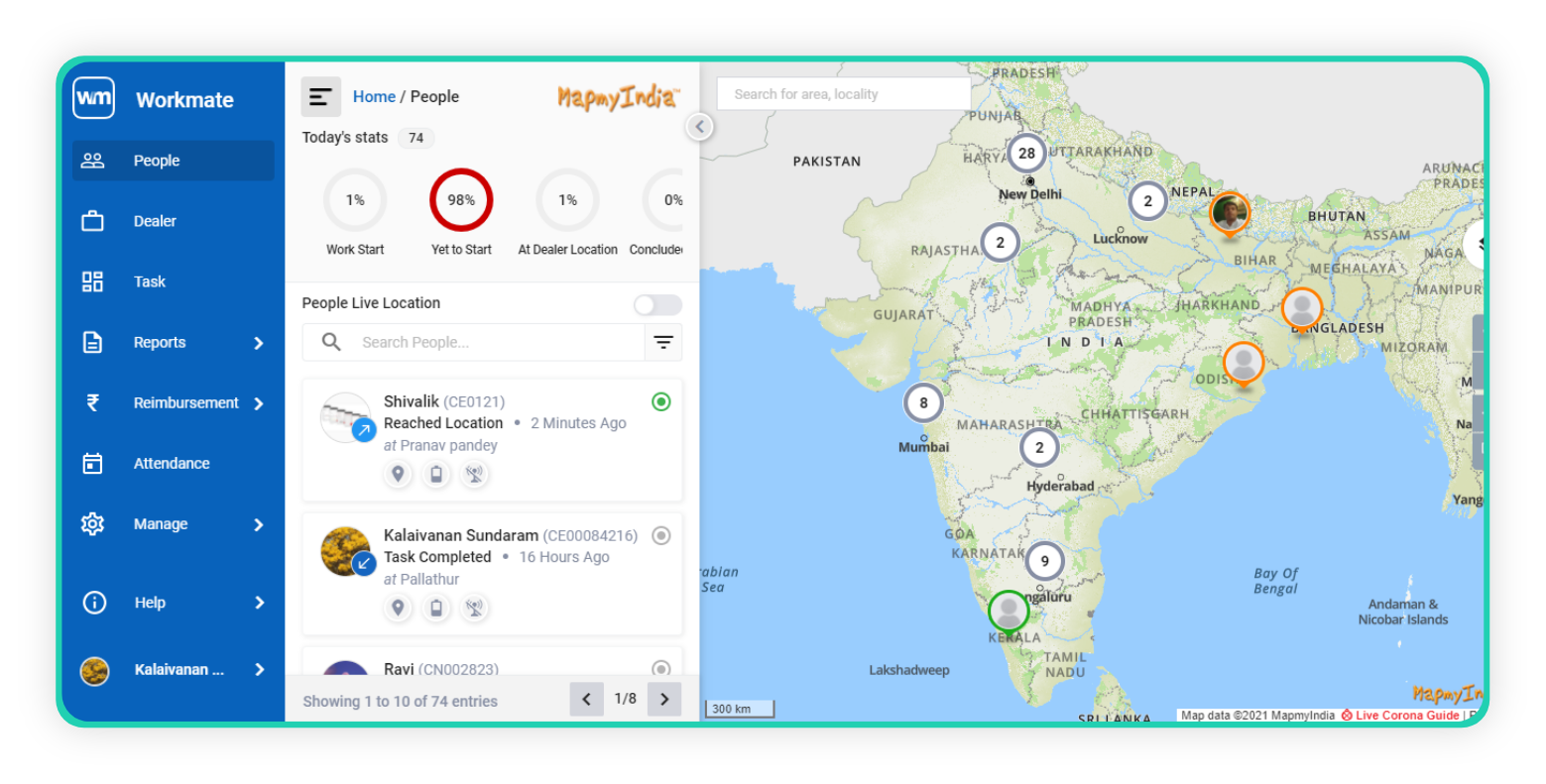

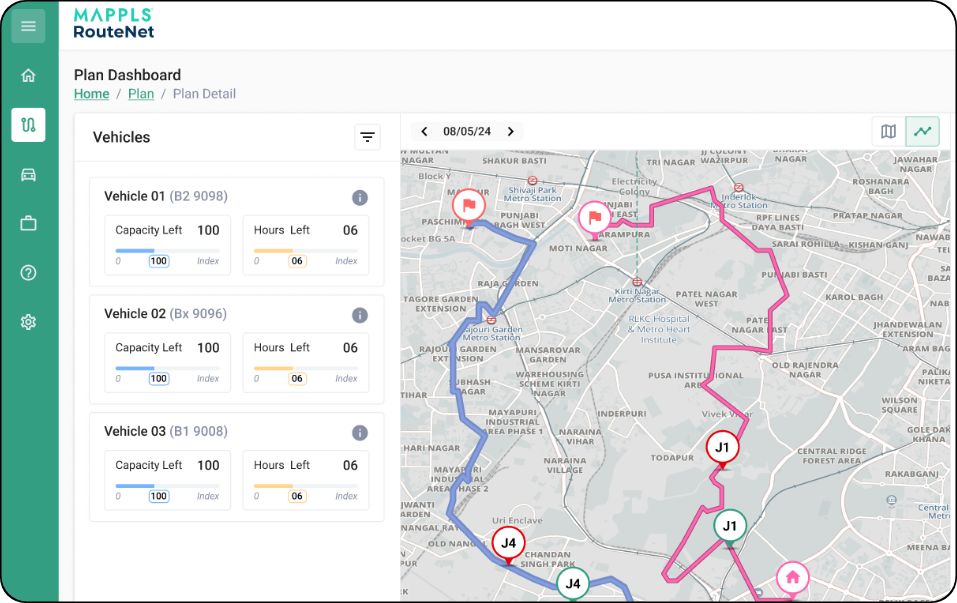

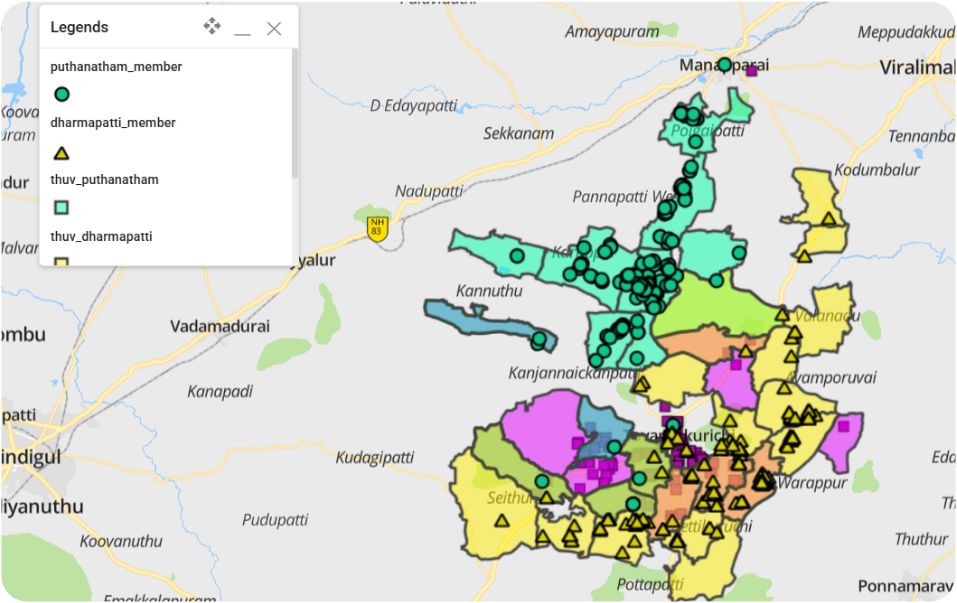

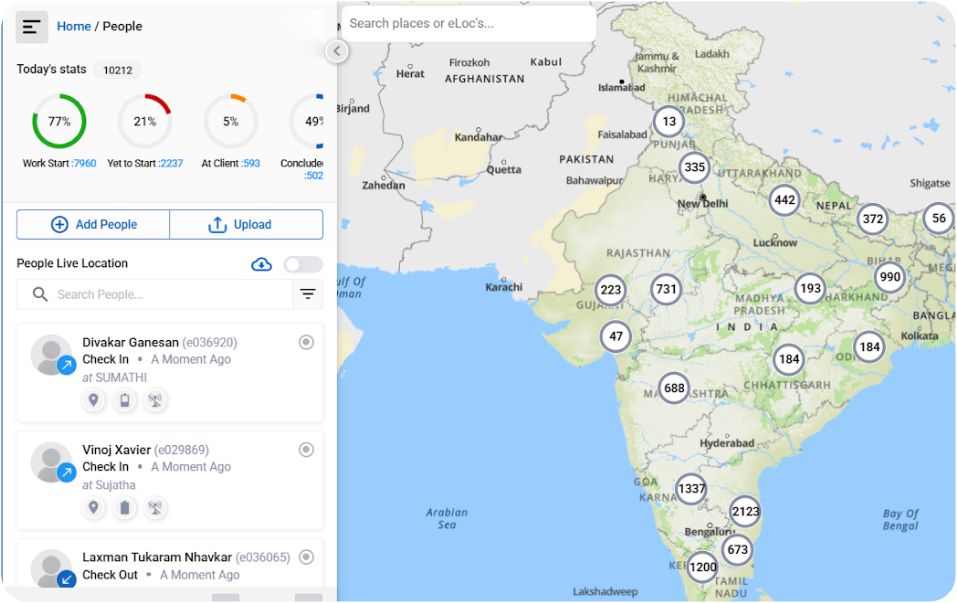

How MapmyIndia’s Workmate is

Powering Field Efficiency in Finance

Digitizing field operations to streamline loan origination, servicing, and collections.